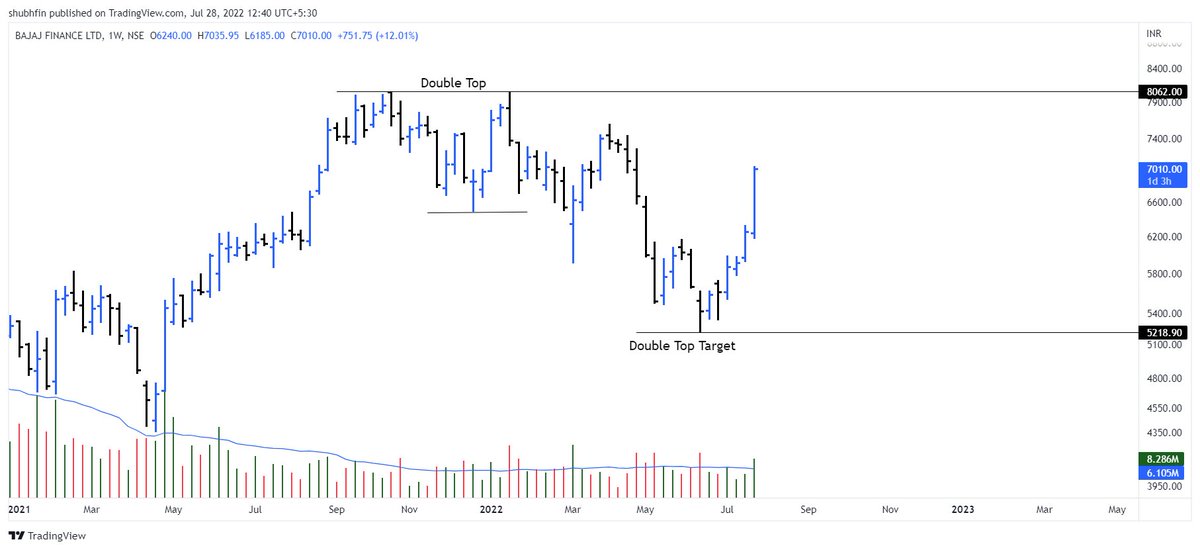

#bajfinance

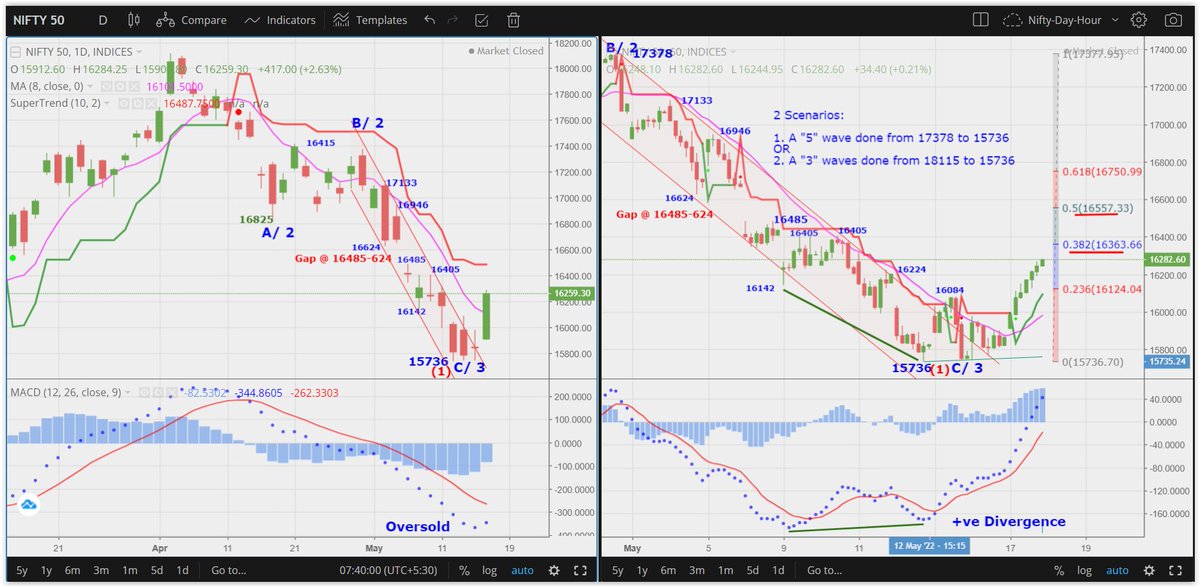

An "ABC" correction ended & "C" wave's "12345" ended in this highly traded stock.

#Elliottwave captures Nature's law, human actions in a collective way

and,

in Top gainers' https://t.co/9bw8A0tgUp

#bajfinance is almost @ sloping channel bottom & has entered the demand zone.

— Van ilango (JustNifty) (@JustNifty) June 22, 2022

One of few stocks that are displaying +ve #Divergence in "Day t/f"

"ABC" correction "almost" done.

Above 5650, mild strength. https://t.co/IJlQ0GKtN3 pic.twitter.com/4uqY0DRqiW

More from Van ilango (JustNifty)

Sometimes extreme volatility brings prices below 21Sma briefly

OR, it just moves between 13 & 21 & move higher

Channel bottom comes around "17300"- no guarantee that every time it touches the channel bottom

Patience pays

IF you miss a trade, wait for the next

They always come🙂🙏 https://t.co/CfVFhgbFxl

OR, it just moves between 13 & 21 & move higher

Channel bottom comes around "17300"- no guarantee that every time it touches the channel bottom

Patience pays

IF you miss a trade, wait for the next

They always come🙂🙏 https://t.co/CfVFhgbFxl

Is it better to buy when price below ema 21 ?\u2026 as SL will be less

— TaksJ (@TaksJoh) February 16, 2022