More from The_Chartist 📈

Tata Elxsi (W) - near to the resistance zone again 5th time. @nishkumar1977 @suru27 @rohanshah619 @indian_stockss @sanstocktrader @BissaGauravB @RajarshitaS @PAVLeader @Rishikesh_ADX @VijayThk @Investor_Mohit @TrendTrader85 @jitendra_stock pic.twitter.com/aIC5kO8XqA

— Steve Nison (@nison_steve) December 18, 2020

More from Bajajfinance

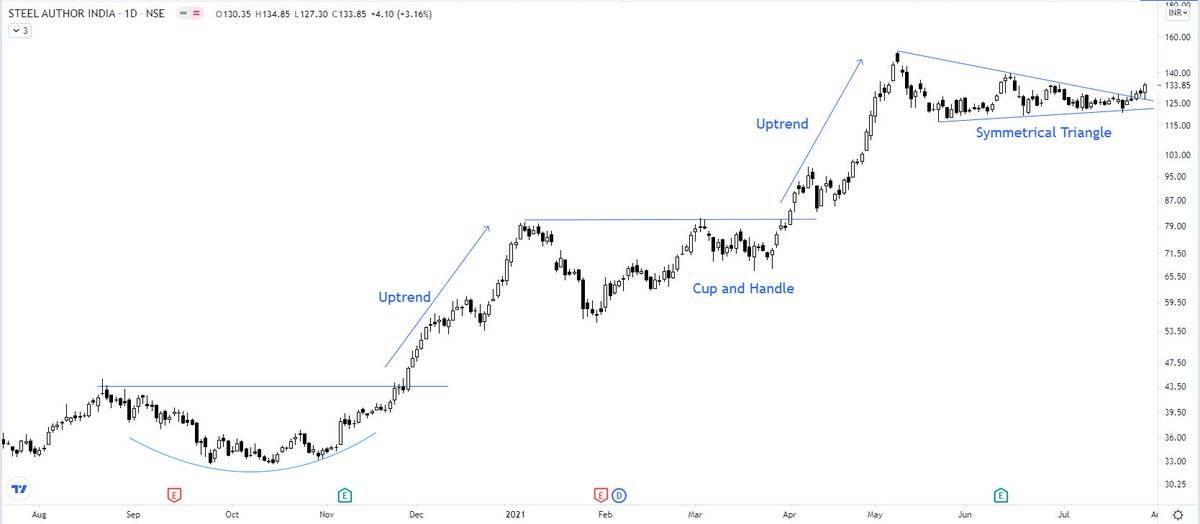

#BAJFINANCE-- When fear was all around pandemic, i prefer to stick to the chart and picked it around 2400 Level now trading with 100+% gain, here is the updated chart and target as per Horizontal Count = 8000, TSL is going to be 4500 going forward. https://t.co/8kRQg1BnQK pic.twitter.com/U6pQj3uvvv

— VVikas Kumaarr (@flyingvikas129) February 7, 2021

You May Also Like

Pangolins, September 2019 and PLA are the key to this mystery

Stay Tuned!

1. Yang

Meet Yang Ruifu, CCP's biological weapons expert https://t.co/JjB9TLEO95 via @Gnews202064

— Billy Bostickson \U0001f3f4\U0001f441&\U0001f441 \U0001f193 (@BillyBostickson) October 11, 2020

Interesting expose of China's top bioweapons expert who oversaw fake pangolin research

Paper 1: https://t.co/TrXESKLYmJ

Paper 2:https://t.co/9LSJTNCn3l

Pangolinhttps://t.co/2FUAzWyOcv pic.twitter.com/I2QMXgnkBJ

2. A jacobin capuchin dangling a flagellin pangolin on a javelin while playing a mandolin and strangling a mannequin on a paladin's palanquin, said Saladin

More to come tomorrow!

3. Yigang Tong

https://t.co/CYtqYorhzH

Archived: https://t.co/ncz5ruwE2W

4. YT Interview

Some bats & pangolins carry viruses related with SARS-CoV-2, found in SE Asia and in Yunnan, & the pangolins carrying SARS-CoV-2 related viruses were smuggled from SE Asia, so there is a possibility that SARS-CoV-2 were coming from