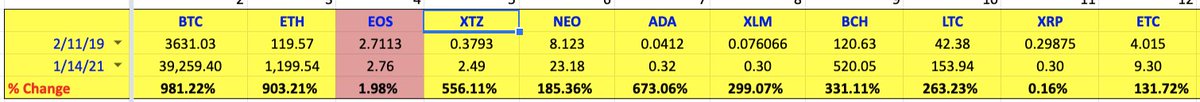

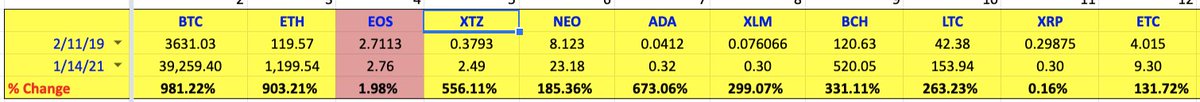

First, let's talk risk/reward. Over the past 2 years, $EOS is the only well-known token other than $XRP that is not higher. In fact, it has underperformed by a LOT.

Even other zombie projects are up 300-1000%

That's a nice start for an investment -- low downside, relatively

Next, the math:

Block One owns 140,000 $BTC. At $2.77, the market cap of $EOS is $2.6 bn, which is only 47% of the value of their BTC holdings.

That means by buying $EOS, you are actually buying $BTC at $18,771. Huge discount.

The question is "can you unlock this value"?

Why does book value matter? Here's a good explanatory thread:

https://t.co/Mp5bn0dbNE $WNXM showed how this works. WNXM traded below BV temporarily, until investors realized the value of the underlying ETH. These are sweet setups and don't last long.

https://t.co/bbEE0CsPJ2

Counter-argument: Generating an ROI from BV is basically a bet on what management will do with that capital, & of course the EOS & Block One teams have done nothing to instill confidence right?...

https://t.co/bKghLv7TmF ...but that's precisely why this is so interesting.

If you think the herd of institutional investors getting into $BTC was fast, wait until activist investors like

@BillAckman @DanielSLoeb1 or Elliott Mgmt find out that you can extract $2.8 Bn from $EOS.

You're crazy if you don't think there will be court cases over $2.8 bn.

Don't think it's possible? See $GNO

GNO used to trade at 30% of BV and there was no link between Gnosis' balance sheet & $GNO.

After

@arca pressured Gnosis to convert its balance sheet into a DAO, GNO now trades at 100% of BV!

GNO is now fully backed!

https://t.co/c5LP2plgqX

At this point, either EOS &

@BrendanBlumer need to

1) create value for $EOS holders ASAP

2) Return the capital

3) Expect huge lawsuits

Any 1 of those 3 options will unlock this value, and close the gap between EOS' market cap and the value of the $BTC on their balance sheet.

What about Dan Larimer leaving? First, what value has Larimer created for anyone other than himself? If anything, this is good for $EOS holders -- now Block One may feel pressure to actually deliver value back to EOS token holders.

https://t.co/IDxuNvkFxN

You don't even need activism. Both $MSTR & $GLXY stock trade at ~2-4x book value despite not generating any meaningful profits outside of $BTC holdings.

Equity investors love cheap assets with potential upside - token investors should too (and will)

https://t.co/pojVADwreD

In general, investing in layer 1 tokens is like buying a call option on future network growth. Most will fail, only one has succeeded $ETH

But I'd rather own $EOS as a free call option rather than pay an incredibly high premium for overvalued ghost protocols $TRX $ADA $XTZ $XLM

Distressed investments have hair on them. This is what makes them profitable (i.e. buying $LEO's new issue at $1, or buying $CEL under $1). The most hated tokens often accrue the most economic value.

"Would you rather be right or make money"?

Few.

@DegenSpartan @cmsholdings

Investing is all about repeatable processes & historical precedent.

We've seen this before. From DigixDAO, $GNO, $WNXM to crypto tracking stocks like $MSTR $GLXY -- book value matters.

I'd be shocked if $EOS doesn't end up back at book value eventually (BV = $5.77 right now)