1/ Raising interest rates can send a shockwave throughout the whole economy.

It can sink consumer confidence, result in fewer jobs, and tank stock prices.

If the Fed goes to fast, it will send the economy into a recession.

So why would they even raise interest rates?

2/ Let's start with the basics

If you borrow money, you will have to pay back a little extra (interest) to make it worth while for the bank.

If you save money, you will be given money (interest) as a reward for keeping money in the bank.

3/ The size of your reward depends on the state of the economy

There is no single interest rate in the economy. You have thousands of commercial banks setting their own interest rate for their customers.

This is all influenced by the central bank (Federal Reserve)

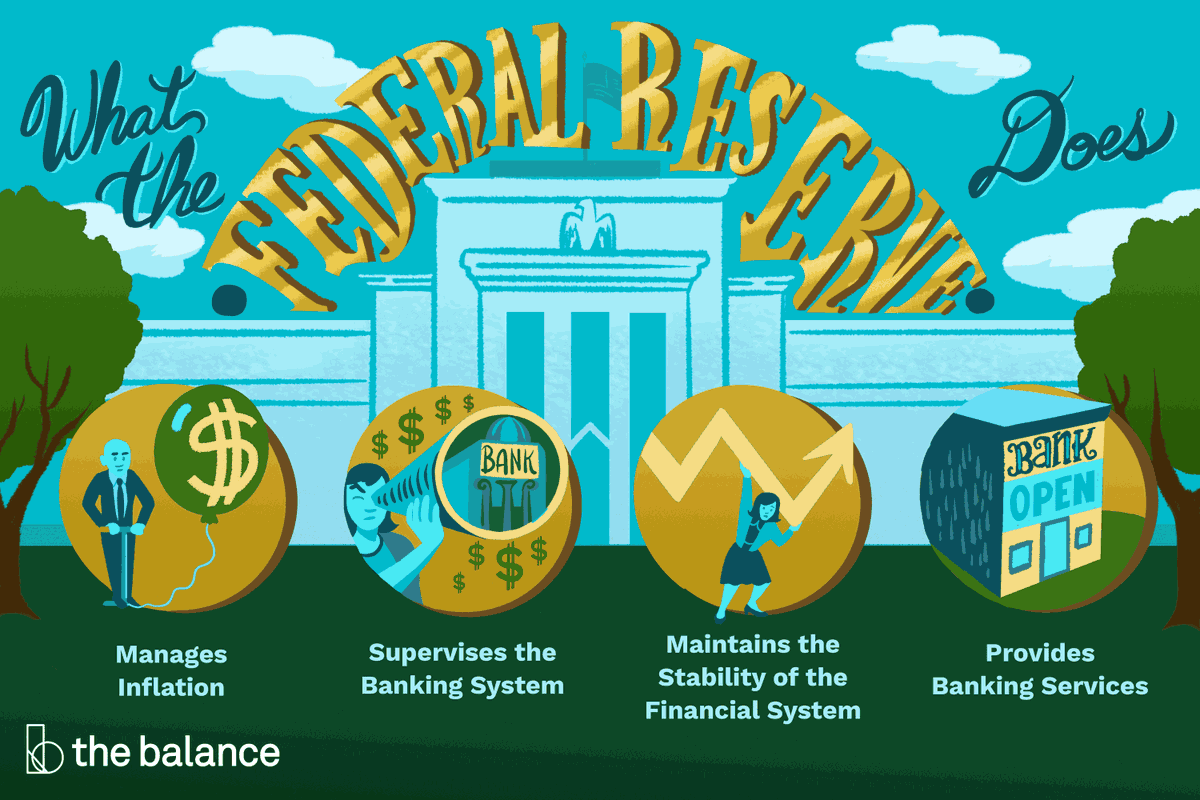

4/ What do Central Banks do?

A central bank is like a bank for banks.

Banks have reserves which is essentially their cash on hand.

Banks can earn interest when they leave their excess reserves with the central bank.

5/ Why do central banks raise interest rates?

When central banks raise interest rates, they are trying to control inflation aka how fast prices rise for everyone.

All central banks are trying to hit an annual inflation rate of 2%

Interest rates are their powerful tool

5A/ A rise in interest rates from a central bank means a commercial bank will earn more on their reserves.

They will make more on their money from keeping it with the central bank than lending it out

If they do lend it out, they will raise their interest rates.

6/ Interest rates and businesses

When interest rates rise, then businesses will find it more expensive to borrow and invest.

This means less economic activity which will leaded to fewer jobs and lower wages.

6A/ Fewer jobs and lower wages will ultimately lead to less money for most households causing consumer confidence to suffer.

This will ultimately lead to households spending less causing businesses to lower prices aka sending inflation down

7/ This sounds straight forward, right?

Unfortunately, the trick is figuring out how far to go with raising interest rates.

In 1981, inflation was at a record high causing interest rates to go to 19%.

This fixed the inflation problem, but it caused widespread economic pain

8/ In 1981, we saw the worst economic mess since the great depression.

It is very difficult to get inflation under control without severely denting economic activity

9/ In theory, a little inflation is okay

Raising interest rates can slow an economy right down.

The problem is that it can take as long as two years to see the full results from interest rates changes

Central banks know this and try to predict the future

10/ Raising interest rates can be painful because slowing the economy is not fun.

But it is worth it to get slow and steady so that in the long run, you don't have to think about it

Thank you for reading!

If you enjoyed this twitter thread:

-RT my first tweet

-Follow me

@investmattallen -Subscribe to my newsletter

I tweet things like this everyday to help you create generational wealth

Every Wednesday, I discuss complex ideas about money, investing, and finance in a simple way.

Typically a 5-minute read and free, it's a no-brainer :)

Sign up:

https://t.co/aDWX10SwoB