In this thread, I will share my thoughts on what caused the depeg.

UST depeg summary: WHY AND WHAT CAUSED UST DEPEG?

Hint is in Anchor protocol and the status of Curve UST pool. @anchor_protocol @terra_money

In this thread, I will share my thoughts on what caused the depeg.

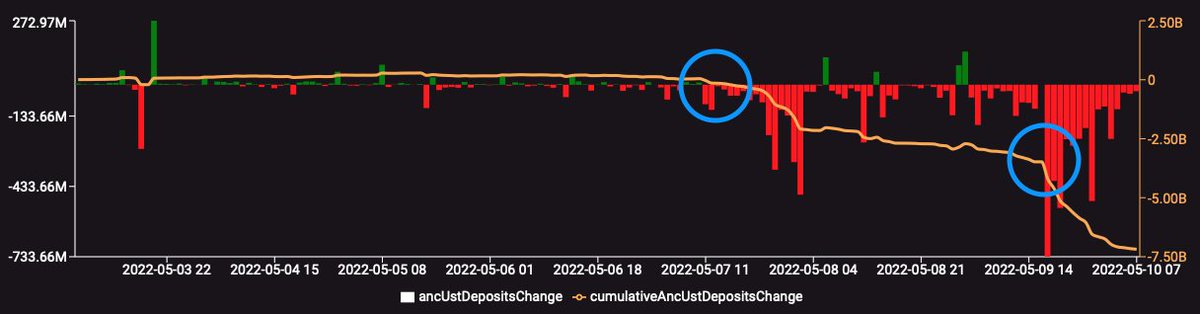

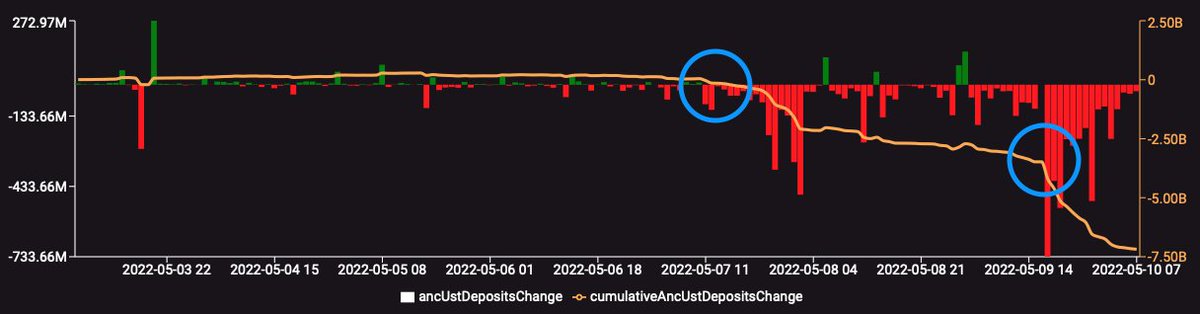

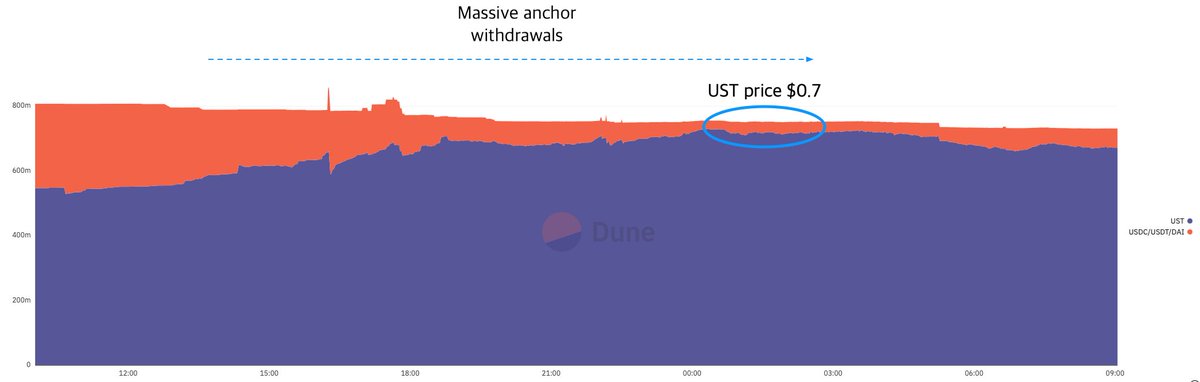

First, UST deposits in Anchor protocol started to exit, which means more circulating UST in the market → sell pressure.

https://t.co/gx9nr7kNcN (05-08-22, 02:30 AM)

https://t.co/bPKhvgfT72 (05-08-22, 02:40 AM)

https://t.co/8Yd056olrL (05-08-22, 03:00 AM)

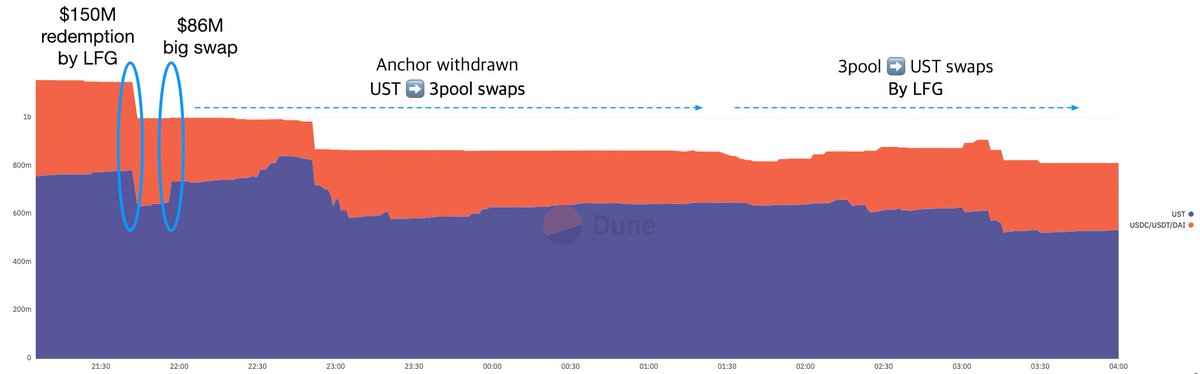

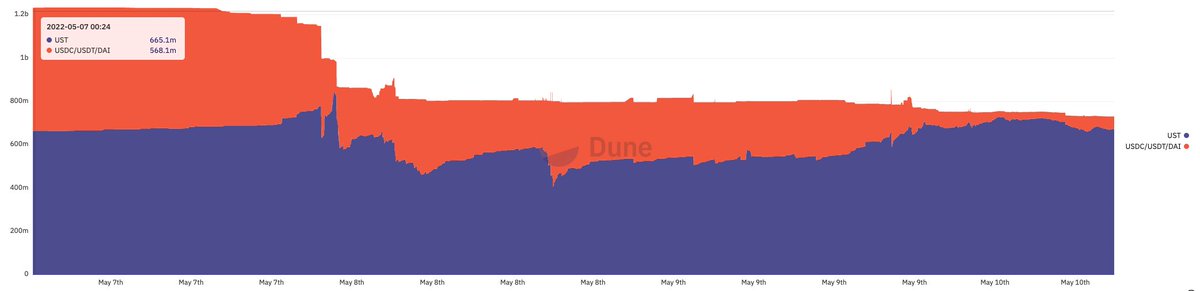

However, one big problem remains. Liquidity decreased a lot in Curve UST3CRV pool. 3CRV tokens were almost drained in the pool compared to week before.

This means, little UST absorption liquidity for downside.

On May 10th, 2022, around 17:00, another massive withdrawls of UST initiated in anchor protocol. $0.8B withdrawls during one hour.

This generated negative feedback loops where Luna price dropped more drastically.

However, in this time, there weren’t much liquidity left in the curve pool.

Therefore, UST price in the pool also dropped significantly even with a stableswap mechanism.

However, it didn’t take long to congest the on-chain vAMM with high spread fees.

- Don’t ever grow the protocol with un-sustainable yields. This will trigger fear during downside.

- Be ware of the status of Curve pool and take care of the liquidity there.

More from All

Viruses and other pathogens are often studied as stand-alone entities, despite that, in nature, they mostly live in multispecies associations called biofilms—both externally and within the host.

https://t.co/FBfXhUrH5d

Microorganisms in biofilms are enclosed by an extracellular matrix that confers protection and improves survival. Previous studies have shown that viruses can secondarily colonize preexisting biofilms, and viral biofilms have also been described.

...we raise the perspective that CoVs can persistently infect bats due to their association with biofilm structures. This phenomenon potentially provides an optimal environment for nonpathogenic & well-adapted viruses to interact with the host, as well as for viral recombination.

Biofilms can also enhance virion viability in extracellular environments, such as on fomites and in aquatic sediments, allowing viral persistence and dissemination.

Hello!! 👋

• I have curated some of the best tweets from the best traders we know of.

• Making one master thread and will keep posting all my threads under this.

• Go through this for super learning/value totally free of cost! 😃

1. 7 FREE OPTION TRADING COURSES FOR

A THREAD:

— Aditya Todmal (@AdityaTodmal) November 28, 2020

7 FREE OPTION TRADING COURSES FOR BEGINNERS.

Been getting lot of dm's from people telling me they want to learn option trading and need some recommendations.

Here I'm listing the resources every beginner should go through to shorten their learning curve.

(1/10)

2. THE ABSOLUTE BEST 15 SCANNERS EXPERTS ARE USING

Got these scanners from the following accounts:

1. @Pathik_Trader

2. @sanjufunda

3. @sanstocktrader

4. @SouravSenguptaI

5. @Rishikesh_ADX

The absolute best 15 scanners which experts are using.

— Aditya Todmal (@AdityaTodmal) January 29, 2021

Got these scanners from the following accounts:

1. @Pathik_Trader

2. @sanjufunda

3. @sanstocktrader

4. @SouravSenguptaI

5. @Rishikesh_ADX

Share for the benefit of everyone.

3. 12 TRADING SETUPS which experts are using.

These setups I found from the following 4 accounts:

1. @Pathik_Trader

2. @sourabhsiso19

3. @ITRADE191

4.

12 TRADING SETUPS which experts are using.

— Aditya Todmal (@AdityaTodmal) February 7, 2021

These setups I found from the following 4 accounts:

1. @Pathik_Trader

2. @sourabhsiso19

3. @ITRADE191

4. @DillikiBiili

Share for the benefit of everyone.

4. Curated tweets on HOW TO SELL STRADDLES.

Everything covered in this thread.

1. Management

2. How to initiate

3. When to exit straddles

4. Examples

5. Videos on

Curated tweets on How to Sell Straddles

— Aditya Todmal (@AdityaTodmal) February 21, 2021

Everything covered in this thread.

1. Management

2. How to initiate

3. When to exit straddles

4. Examples

5. Videos on Straddles

Share if you find this knowledgeable for the benefit of others.