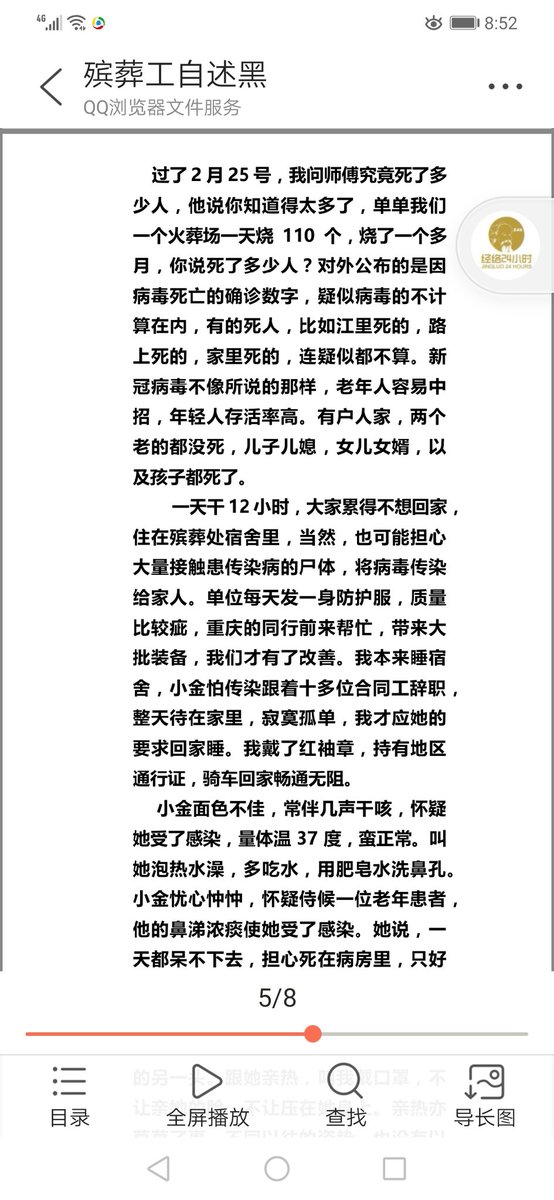

Papa has a suitcase full of LIC bonds, I wanted to dig around returns so went LIC office yesterday to get the surrender value quotes. 📈

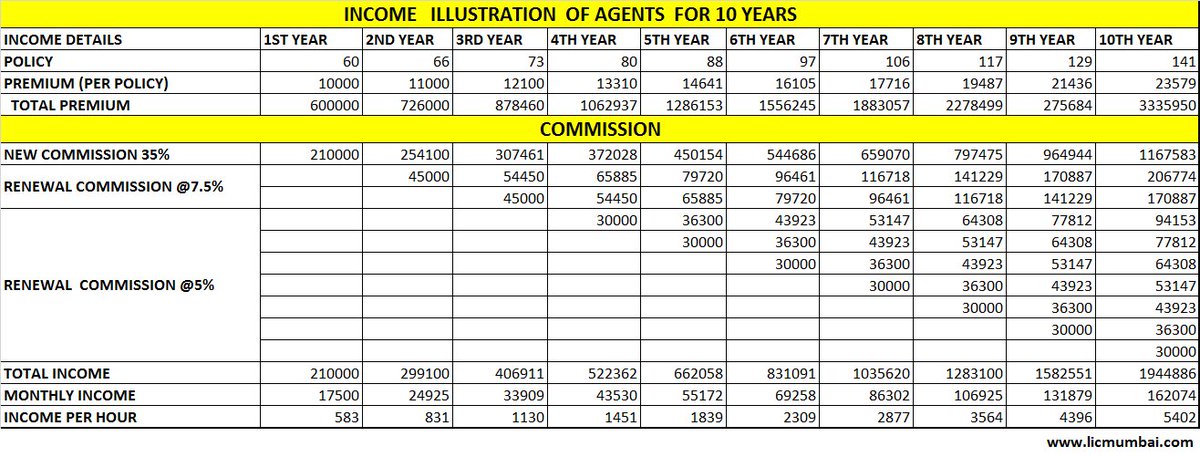

Read this Mini Thread 🧵 before your family LIC uncle tries to sell you the next policy!

‘Don’t mis insurance with an Investment.’

You can sell anything in India if you can play around emotion and trust, LIC has built a robust network of branch, distributors/agents.

Just check the global and Indian market share of LIC.

Now, Compare the returns with FD, Gold and Mutual Funds and instruments you feel comfortable investing.

Well they say - ‘Zindagi ke Sath bhi, Zindagi ke Bad Bhi.’

Guaranteed poor returns seem missing in the line. ❌

(Important)

They trap you with poor insurance plans while they themselves invest in equities.

Well LIC booked a whopping record ₹37,000 crore profit from share sales in 2020-21, the highest in its 65-year history!

https://t.co/5qfIiWktxN

Be informed about your investment decisions, if you liked reading this thread please consider RT so it reaches more people. 🙏

Happy Investing.💰

https://t.co/wDV9kQWOxN

How to choose a Debit Card? \U0001f4b3\U0001f3e6

— Ravisutanjani Kumar (@Ravisutanjani) July 5, 2021

Why? Because not everyone feels suitable with Credit Cards so what are their options?

We want good rewards, lounge, cashback, free insurance, and premium benefits but how to go with one?

A Thread \U0001f9f5

More from All

You May Also Like

Hello!! 👋

• I have curated some of the best tweets from the best traders we know of.

• Making one master thread and will keep posting all my threads under this.

• Go through this for super learning/value totally free of cost! 😃

1. 7 FREE OPTION TRADING COURSES FOR

A THREAD:

— Aditya Todmal (@AdityaTodmal) November 28, 2020

7 FREE OPTION TRADING COURSES FOR BEGINNERS.

Been getting lot of dm's from people telling me they want to learn option trading and need some recommendations.

Here I'm listing the resources every beginner should go through to shorten their learning curve.

(1/10)

2. THE ABSOLUTE BEST 15 SCANNERS EXPERTS ARE USING

Got these scanners from the following accounts:

1. @Pathik_Trader

2. @sanjufunda

3. @sanstocktrader

4. @SouravSenguptaI

5. @Rishikesh_ADX

The absolute best 15 scanners which experts are using.

— Aditya Todmal (@AdityaTodmal) January 29, 2021

Got these scanners from the following accounts:

1. @Pathik_Trader

2. @sanjufunda

3. @sanstocktrader

4. @SouravSenguptaI

5. @Rishikesh_ADX

Share for the benefit of everyone.

3. 12 TRADING SETUPS which experts are using.

These setups I found from the following 4 accounts:

1. @Pathik_Trader

2. @sourabhsiso19

3. @ITRADE191

4.

12 TRADING SETUPS which experts are using.

— Aditya Todmal (@AdityaTodmal) February 7, 2021

These setups I found from the following 4 accounts:

1. @Pathik_Trader

2. @sourabhsiso19

3. @ITRADE191

4. @DillikiBiili

Share for the benefit of everyone.

4. Curated tweets on HOW TO SELL STRADDLES.

Everything covered in this thread.

1. Management

2. How to initiate

3. When to exit straddles

4. Examples

5. Videos on

Curated tweets on How to Sell Straddles

— Aditya Todmal (@AdityaTodmal) February 21, 2021

Everything covered in this thread.

1. Management

2. How to initiate

3. When to exit straddles

4. Examples

5. Videos on Straddles

Share if you find this knowledgeable for the benefit of others.

A thread 👇

https://t.co/xj4js6shhy

Entrepreneur\u2019s mind.

— James Clear (@JamesClear) August 22, 2020

Athlete\u2019s body.

Artist\u2019s soul.

https://t.co/b81zoW6u1d

When you choose who to follow on Twitter, you are choosing your future thoughts.

— James Clear (@JamesClear) October 3, 2020

https://t.co/1147it02zs

Working on a problem reduces the fear of it.

— James Clear (@JamesClear) August 30, 2020

It\u2019s hard to fear a problem when you are making progress on it\u2014even if progress is imperfect and slow.

Action relieves anxiety.

https://t.co/A7XCU5fC2m

We often avoid taking action because we think "I need to learn more," but the best way to learn is often by taking action.

— James Clear (@JamesClear) September 23, 2020