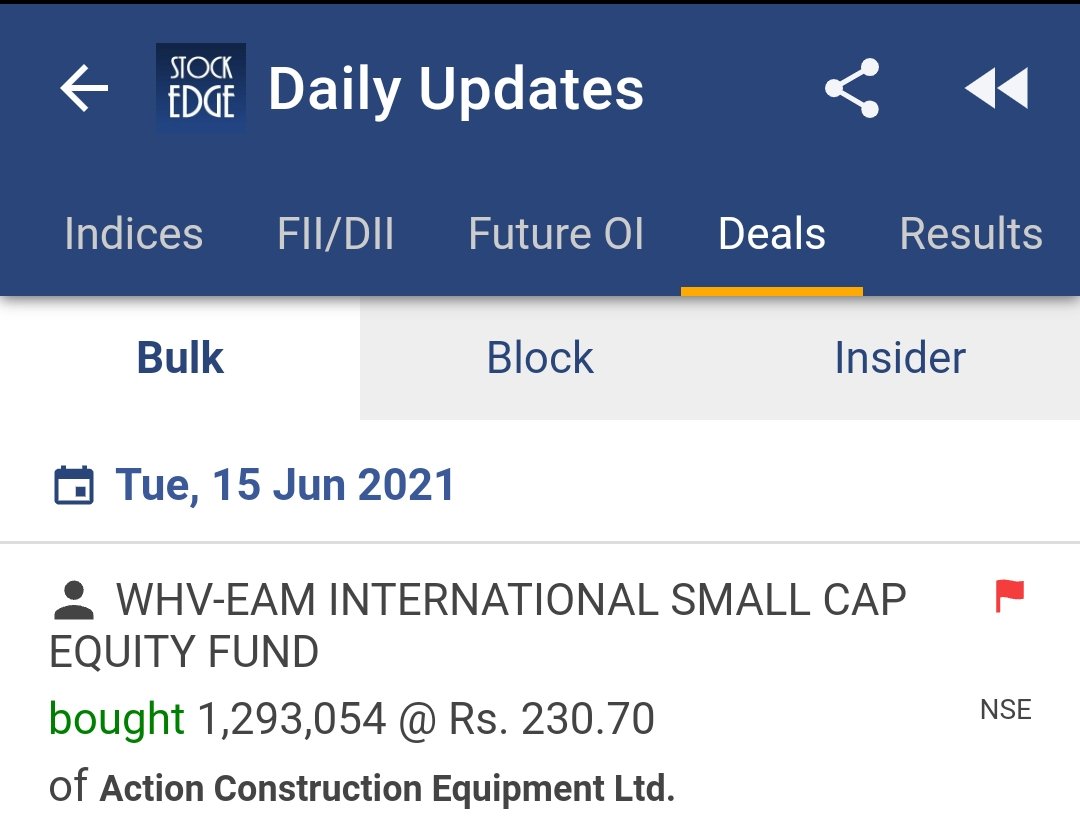

Action construction equipment

#ACE

WHV-EAM International smallcap equity fund purchases 12,93,054 shares of action construction at 231rs today

They last bought Lux industries on 26th May

1,44,080 shares at 2537rs

More from Shreenidhi P

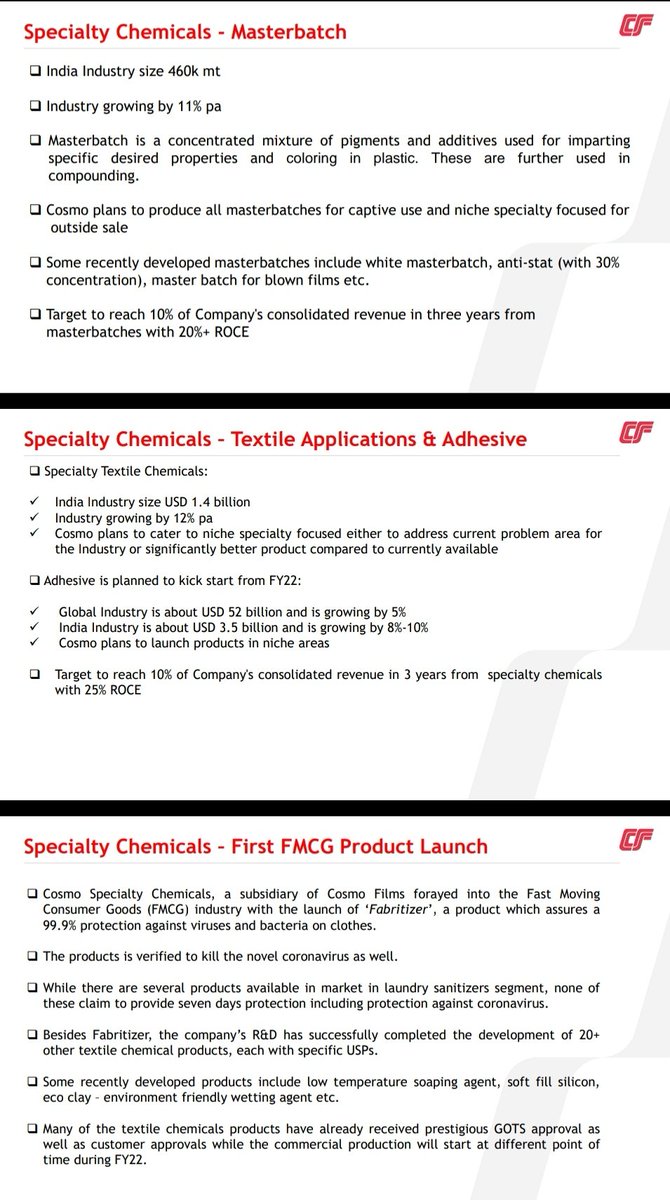

Investor ppt

Splty side:3yr target

Masterbatches-10% rev,20% RoCE

Textile chem-10% rev,25% RoCE

FMCG-Fabricizer launched

30% RoE,22% RoCE-fy21

1% shift in splty adds 5cr EBITDA

Target-62% to 80%

Net d/e 0.5x

D/EBITDA 1x

Petcare-plans 2 demerge in2 seperate entity https://t.co/Iq4VT6tG50

Cosmo films#cosmofilms

— Shreenidhi P (@nid_rockz) August 4, 2021

Probably the best results of the day

Glimpse of last 5qtr

Rev,EBITDA,pbt n PAT growth every qtr

Highest OPM 19%

Q1 EBITDA 132cr n PBT 116cr

Last 5yrs

OPM 7% to 17%\U0001f44c

80% pf-speciality-fy23

Superb debt management

Liberal dividend n buyback

Solid OCF\U0001f44c pic.twitter.com/6ulhmHZf24

You May Also Like

Curated the best tweets from the best traders who are exceptional at managing strangles.

• Positional Strangles

• Intraday Strangles

• Position Sizing

• How to do Adjustments

• Plenty of Examples

• When to avoid

• Exit Criteria

How to sell Strangles in weekly expiry as explained by boss himself. @Mitesh_Engr

• When to sell

• How to do Adjustments

• Exit

1. Let's start option selling learning.

— Mitesh Patel (@Mitesh_Engr) February 10, 2019

Strangle selling. ( I am doing mostly in weekly Bank Nifty)

When to sell? When VIX is below 15

Assume spot is at 27500

Sell 27100 PE & 27900 CE

say premium for both 50-50

If bank nifty will move in narrow range u will get profit from both.

Beautiful explanation on positional option selling by @Mitesh_Engr

Sir on how to sell low premium strangles yourself without paying anyone. This is a free mini course in

Few are selling 20-25 Rs positional option selling course.

— Mitesh Patel (@Mitesh_Engr) November 3, 2019

Nothing big deal in that.

For selling weekly option just identify last week low and high.

Now from that low and high keep 1-1.5% distance from strike.

And sell option on both side.

1/n

1st Live example of managing a strangle by Mitesh Sir. @Mitesh_Engr

• Sold Strangles 20% cap used

• Added 20% cap more when in profit

• Booked profitable leg and rolled up

• Kept rolling up profitable leg

• Booked loss in calls

• Sold only

Sold 29200 put and 30500 call

— Mitesh Patel (@Mitesh_Engr) April 12, 2019

Used 20% capital@44 each

2nd example by @Mitesh_Engr Sir on converting a directional trade into strangles. Option Sellers can use this for consistent profit.

• Identified a reversal and sold puts

• Puts decayed a lot

• When achieved 2% profit through puts then sold

Already giving more than 2% return in a week. Now I will prefer to sell 32500 call at 74 to make it strangle in equal ratio.

— Mitesh Patel (@Mitesh_Engr) February 7, 2020

To all. This is free learning for you. How to play option to make consistent return.

Stay tuned and learn it here free of cost. https://t.co/7J7LC86oW0