SeekerHari Authors Aksel Kibar, CMT

7 days

30 days

All time

Recent

Popular

(1) Let's study this chart and discuss some of the concepts in classical charting & technical analysis. It is a great chart. https://t.co/eYhQE2QuJ0

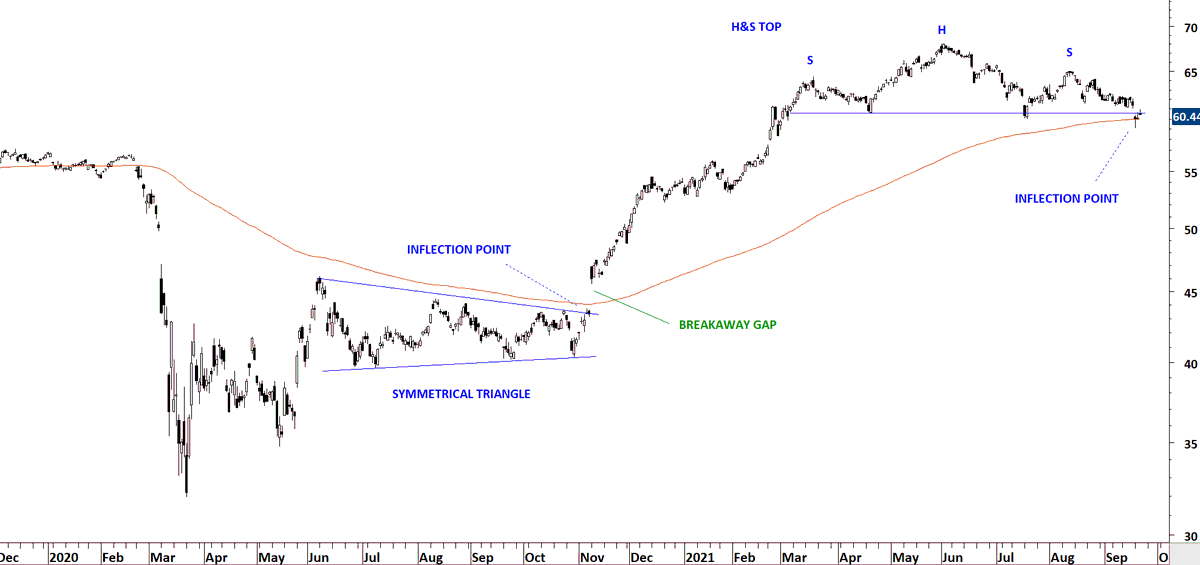

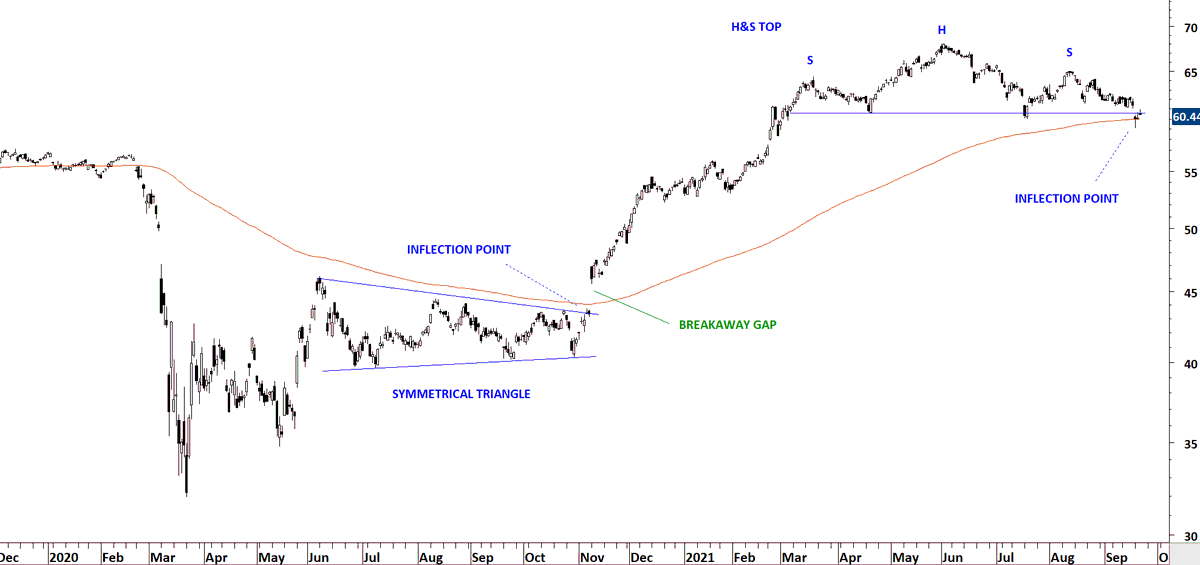

(2) Symmetrical triangle formed right below the 200-day average. Breakout took place at the same price level which I call inflection point. When such condition is met, it is a high conviction setup for me.

(3) Breakout took place with a gap opening. This was a clear breakaway gap as explained by Schabacker.

Breakout took place above the 200-day average and it was a change in trend as well. A significant technical development.

(4) Now, a clean H&S top has formed with price testing the 200-day average forming what I call an inflection point. Means: if a breakdown takes place it will be a high conviction signal. A possible change in trend.

Implications of breakaway gap... Richard Schabacker pic.twitter.com/HlXhwUxanV

— Aksel Kibar, CMT (@TechCharts) September 22, 2021

(2) Symmetrical triangle formed right below the 200-day average. Breakout took place at the same price level which I call inflection point. When such condition is met, it is a high conviction setup for me.

(3) Breakout took place with a gap opening. This was a clear breakaway gap as explained by Schabacker.

Breakout took place above the 200-day average and it was a change in trend as well. A significant technical development.

(4) Now, a clean H&S top has formed with price testing the 200-day average forming what I call an inflection point. Means: if a breakdown takes place it will be a high conviction signal. A possible change in trend.