Jacobtldr Categories Investing

7 days

30 days

All time

Recent

Popular

THE MONEY PRINTING GAME:

A pleb's guide to using @Keeper_DAO's hiding game to acquire $Rook below market price and arb it like a pro.

Before reading this thread, please read this one to provide a bit of context:

https://t.co/jLeUJRIjLG

Here we go!

1/

Before we really get into the meat of this... please do understand that the hiding game is currently in alpha. Hardware wallets don't work w/ it yet (they will soon).

Sometimes orders go unfilled (improving every day).

2/

A bit more context:

Limit orders on an amm aren't limit orders in the traditional sense. They are actually arbitrage opportunities for keepers. Keepers are bots that operate in the dark forest of ethereum.

3/

Now, let's say you use a service like 1inch or matcha to set your limit orders.

Let's say eth is $900 and you want to sell at $1000.

Eth pumps to $1040 rapidly, a keeper fills your limit order for $1000... everyone is happy. But wait... who gets the extra $40 here?

4/

Hint: it's not you! But what if you could?

This is where the hiding game comes in.

https://t.co/6sBlUWfw00

When you submit a limit order through the hiding game, @Keeper_DAO takes the $40 (or w/e amount) referenced above (this is MEV) and pushes it to the treasury.

5/

A pleb's guide to using @Keeper_DAO's hiding game to acquire $Rook below market price and arb it like a pro.

Before reading this thread, please read this one to provide a bit of context:

https://t.co/jLeUJRIjLG

Here we go!

1/

Ok I couldn't resist myself...

— 0x_Infinitum (@CryptoMessiah) February 3, 2021

OOOONNEEE more $Rook post.

Before i get into the REALLY cool shit i want to talk about, let me discuss the arb mining mechanics that were present during the initial distribution phase.

See this image, that's the keeperdao treasury.

1/ pic.twitter.com/Z2sMsZN9jo

Before we really get into the meat of this... please do understand that the hiding game is currently in alpha. Hardware wallets don't work w/ it yet (they will soon).

Sometimes orders go unfilled (improving every day).

2/

A bit more context:

Limit orders on an amm aren't limit orders in the traditional sense. They are actually arbitrage opportunities for keepers. Keepers are bots that operate in the dark forest of ethereum.

3/

Now, let's say you use a service like 1inch or matcha to set your limit orders.

Let's say eth is $900 and you want to sell at $1000.

Eth pumps to $1040 rapidly, a keeper fills your limit order for $1000... everyone is happy. But wait... who gets the extra $40 here?

4/

Hint: it's not you! But what if you could?

This is where the hiding game comes in.

https://t.co/6sBlUWfw00

When you submit a limit order through the hiding game, @Keeper_DAO takes the $40 (or w/e amount) referenced above (this is MEV) and pushes it to the treasury.

5/

🔎 $RTP/@hippo_insurance: SaaS harnessing AI to revolutionize the home insurance industry 🦛🏠

- Everything you need to know

- One-stop-shop for all things smart/connected home

- Higher growth & revenue than closest public competitor $LMND/@Lemonade_Inc

Time for a thread 🧵⬇️

Hippo was founded in 2015 by Assaf Wand, an ex-McKinsey consultant and Eyal Navon, serial entreprenuer and software engineer.

Wand's interest in insurance was inspired by his father's lengthy career in the "antiquated" insurance industry. $RTP

After two years of R&D, fundraising, and product development, Hippo launched in April 2017 in California.

The company's marketing was centered on the delivery of a 60-sec quote for insurance policies, transparent process, and smart home integration.

https://t.co/msy9u2ZpST $RTP

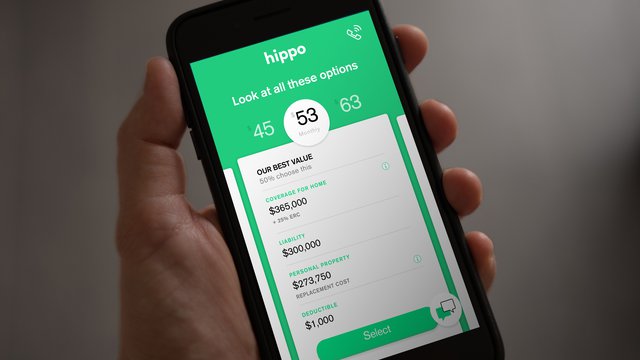

By March 2019, with Hippo insurance available to more than 50% of the homeowners in the US, the company reported a 25% month-over-month sales growth and total insured property value of more than $50 billion, with a 93% customer retention rate.

https://t.co/D5AyWgonVp $RTP

Hippo is going after a slightly different market. Most of the new insurance companies have pitched services to renters and city dwellers made up of the mostly millennial demographic, while Hippo is aiming its services squarely at homeowners. $RTP

https://t.co/MYo9HWDmdV

- Everything you need to know

- One-stop-shop for all things smart/connected home

- Higher growth & revenue than closest public competitor $LMND/@Lemonade_Inc

Time for a thread 🧵⬇️

Hippo was founded in 2015 by Assaf Wand, an ex-McKinsey consultant and Eyal Navon, serial entreprenuer and software engineer.

Wand's interest in insurance was inspired by his father's lengthy career in the "antiquated" insurance industry. $RTP

After two years of R&D, fundraising, and product development, Hippo launched in April 2017 in California.

The company's marketing was centered on the delivery of a 60-sec quote for insurance policies, transparent process, and smart home integration.

https://t.co/msy9u2ZpST $RTP

By March 2019, with Hippo insurance available to more than 50% of the homeowners in the US, the company reported a 25% month-over-month sales growth and total insured property value of more than $50 billion, with a 93% customer retention rate.

https://t.co/D5AyWgonVp $RTP

Hippo is going after a slightly different market. Most of the new insurance companies have pitched services to renters and city dwellers made up of the mostly millennial demographic, while Hippo is aiming its services squarely at homeowners. $RTP

https://t.co/MYo9HWDmdV