CodyyyGardner Authors Ram Bhupatiraju

7 days

30 days

All time

Recent

Popular

Happy 2⃣0⃣2⃣1⃣ to all.🎇

For any Learning machines out there, here are a list of my fav online investing resources. Feel free to add yours.

Let's dive in.

⬇️⬇️⬇️

Investing Services

✔️ @themotleyfool - @TMFStockAdvisor & @TMFRuleBreakers services

✔️ @7investing

✔️ @investing_city

https://t.co/9aUK1Tclw4

✔️ @MorningstarInc Premium

✔️ @SeekingAlpha Marketplaces (Check your area of interest, Free trials, Quality, track record...)

General Finance/Investing

✔️ @morganhousel

https://t.co/f1joTRaG55

✔️ @dollarsanddata

https://t.co/Mj1owkzRc8

✔️ @awealthofcs

https://t.co/y81KHfh8cn

✔️ @iancassel

https://t.co/KEMTBHa8Qk

✔️ @InvestorAmnesia

https://t.co/zFL3H2dk6s

✔️

Tech focused

✔️ @stratechery

https://t.co/VsNwRStY9C

✔️ @bgurley

https://t.co/NKXGtaB6HQ

✔️ @CBinsights

https://t.co/H77hNp2X5R

✔️ @benedictevans

https://t.co/nyOlasCY1o

✔️

Tech Deep dives

✔️ @StackInvesting

https://t.co/WQ1yBYzT2m

✔️ @hhhypergrowth

https://t.co/kcLKITRLz1

✔️ @Beth_Kindig

https://t.co/CjhLRdP7Rh

✔️ @SeifelCapital

https://t.co/CXXG5PY0xX

✔️ @borrowed_ideas

For any Learning machines out there, here are a list of my fav online investing resources. Feel free to add yours.

Let's dive in.

⬇️⬇️⬇️

Investing Services

✔️ @themotleyfool - @TMFStockAdvisor & @TMFRuleBreakers services

✔️ @7investing

✔️ @investing_city

https://t.co/9aUK1Tclw4

✔️ @MorningstarInc Premium

✔️ @SeekingAlpha Marketplaces (Check your area of interest, Free trials, Quality, track record...)

General Finance/Investing

✔️ @morganhousel

https://t.co/f1joTRaG55

✔️ @dollarsanddata

https://t.co/Mj1owkzRc8

✔️ @awealthofcs

https://t.co/y81KHfh8cn

✔️ @iancassel

https://t.co/KEMTBHa8Qk

✔️ @InvestorAmnesia

https://t.co/zFL3H2dk6s

✔️

Tech focused

✔️ @stratechery

https://t.co/VsNwRStY9C

✔️ @bgurley

https://t.co/NKXGtaB6HQ

✔️ @CBinsights

https://t.co/H77hNp2X5R

✔️ @benedictevans

https://t.co/nyOlasCY1o

✔️

Tech Deep dives

✔️ @StackInvesting

https://t.co/WQ1yBYzT2m

✔️ @hhhypergrowth

https://t.co/kcLKITRLz1

✔️ @Beth_Kindig

https://t.co/CjhLRdP7Rh

✔️ @SeifelCapital

https://t.co/CXXG5PY0xX

✔️ @borrowed_ideas

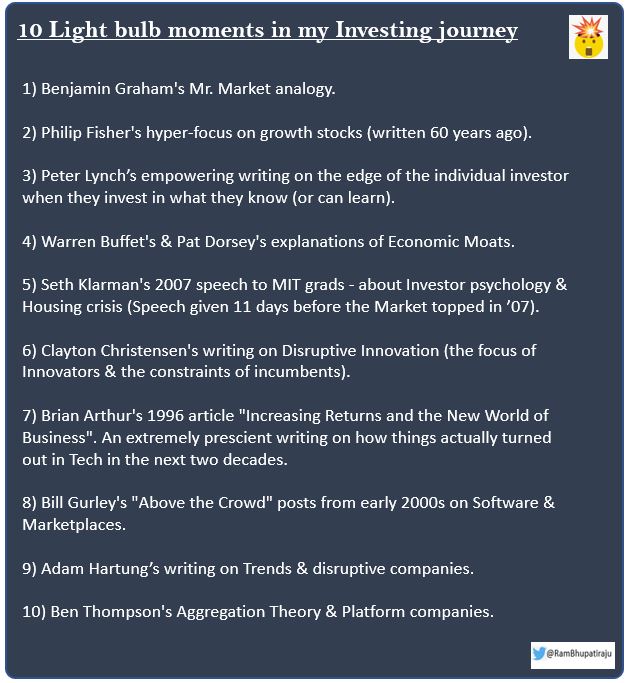

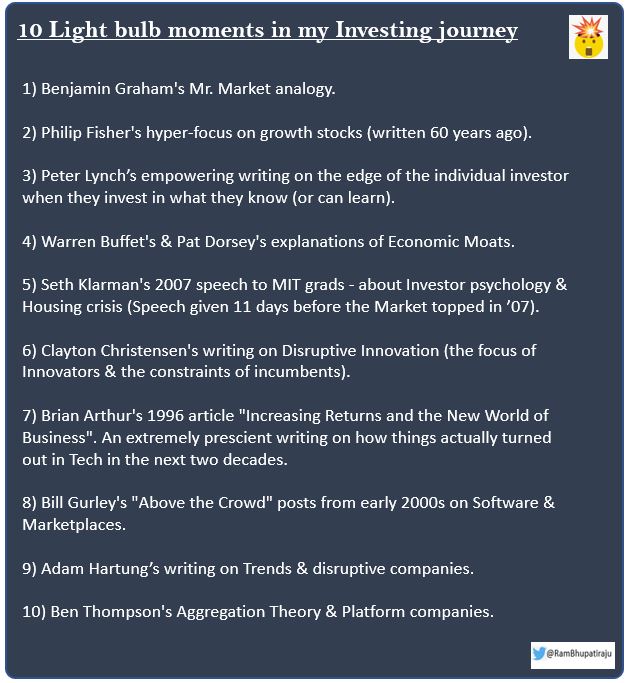

🔟Investing concepts that blew my mind🤯when I read them, and greatly helped my investing journey.

Would love to know about some of yours.

@saxena_puru @BrianFeroldi @GavinSBaker @7Innovator @dhaval_kotecha @Gautam__Baid @richard_chu97 @10kdiver @FromValue @investing_city

Below thread has the references to each of these 10 concepts.

Note : Many of these are my past Tweets related to these topics. Not trying to self promote them. Adding them only because they have the original links, added context and my highlights & fav pts.

Let's dive in. ⬇️⬇️

1⃣ Benjamin Graham's Mr. Market analogy.

An extremely useful concept, especially when

Market is panicking (& throwing out good Co's at bargain prices) & when

Market is too complacent (& awarding high valuations to hype and

2⃣ Philip Fisher's hyper-focus on growth stocks (written 60 years ago).

Very useful and mostly still applicable stuff on how to deeply analyze Growth Co's (except Stock based Compensation & Adjusted EBITDA of

3⃣ Peter Lynch’s empowering writing on the edge of the individual investor when they invest in what they know (or can

Would love to know about some of yours.

@saxena_puru @BrianFeroldi @GavinSBaker @7Innovator @dhaval_kotecha @Gautam__Baid @richard_chu97 @10kdiver @FromValue @investing_city

Below thread has the references to each of these 10 concepts.

Note : Many of these are my past Tweets related to these topics. Not trying to self promote them. Adding them only because they have the original links, added context and my highlights & fav pts.

Let's dive in. ⬇️⬇️

1⃣ Benjamin Graham's Mr. Market analogy.

An extremely useful concept, especially when

Market is panicking (& throwing out good Co's at bargain prices) & when

Market is too complacent (& awarding high valuations to hype and

Excellent compilation of quotes from Benjamin Graham's "The Intelligent Investor". \U0001f44f

— Ram Bhupatiraju (@RamBhupatiraju) May 25, 2020

cc: @dmuthuk @Gautam__Baidhttps://t.co/LNKNVXVj1b

2⃣ Philip Fisher's hyper-focus on growth stocks (written 60 years ago).

Very useful and mostly still applicable stuff on how to deeply analyze Growth Co's (except Stock based Compensation & Adjusted EBITDA of

Great summary of Philip Fisher's "Common Stocks and Uncommon Profits". It's no secret that this is one of THE BEST books for Individual investors but it's still enlightening to re-read the book or these summaries.\U0001f44d

— Ram Bhupatiraju (@RamBhupatiraju) June 4, 2020

cc:@saxena_puru @Gautam__Baid @dmuthukhttps://t.co/u16X3CKj8V

3⃣ Peter Lynch’s empowering writing on the edge of the individual investor when they invest in what they know (or can

Peter Lynch's "Use Your Edge" essay has some great lessons for individual investors. \U0001f44f

— Ram Bhupatiraju (@RamBhupatiraju) November 25, 2020

Solid advice at the end of the article (my fav points highlighted).\U0001f447https://t.co/nkUVDh0NVA pic.twitter.com/aQ1eFr2SGC